This obviously can create problems in the future. Nearly half of American adults can’t cover an emergency expense of $400 without selling something or borrowing money, and 31% of non-retired adults have no retirement savings or pension at all.[2] Is there a way to get better at saving money? Yes, here’s a challenge you can take to turn around the situation.

The 52 Week Money Challenge

The 52 Week Money Challenge is fairly simple.

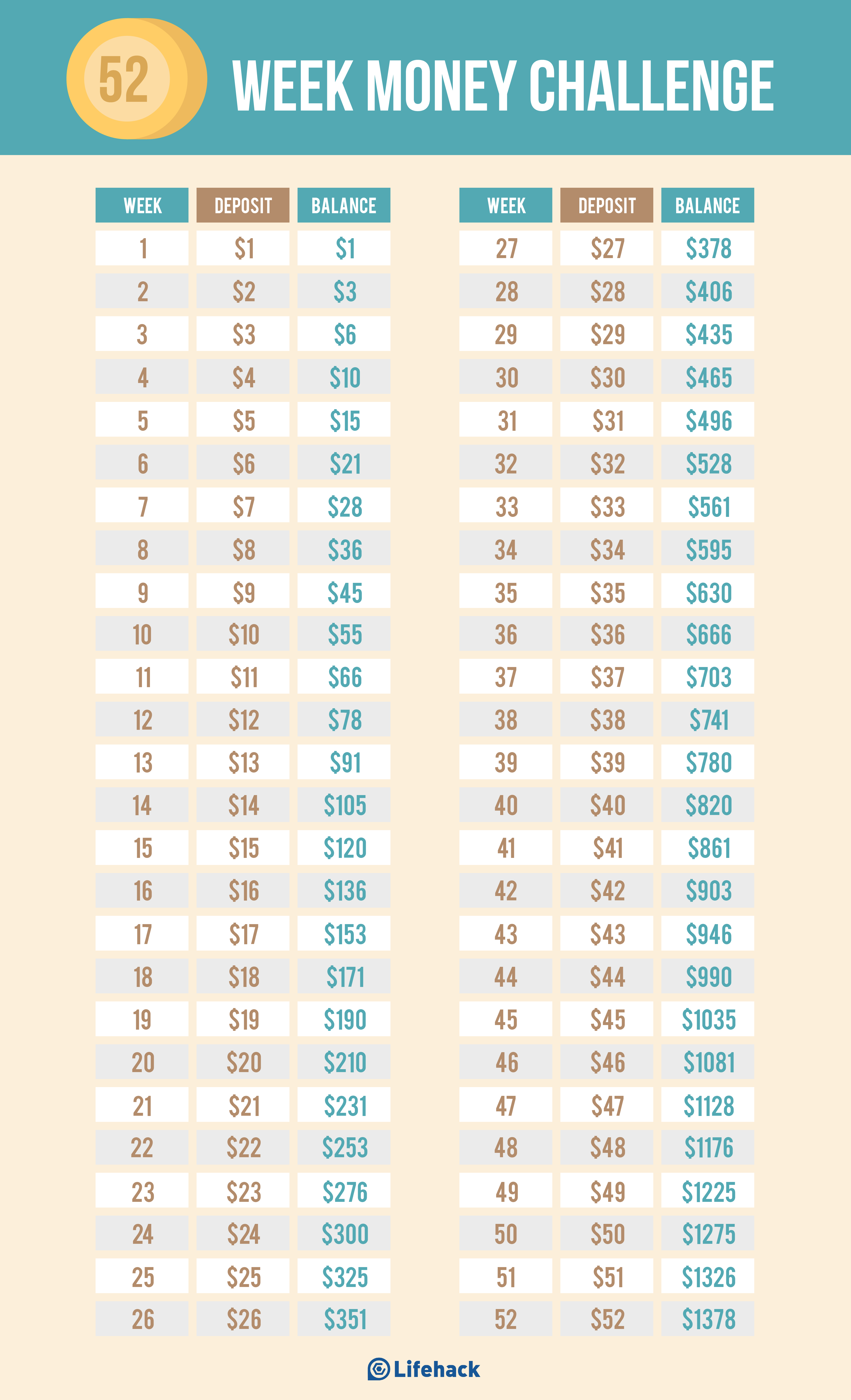

On Week 1, you deposit $1 in savings. Now your total is $1. On Week 2, you deposit $2, for a new total of $3.

If you follow this for 52 weeks, your eventual total for the year will be $1,378. Here’s a table showcasing it visually:

The 52-Week Money Challenge works because of habitual momentum. You have a commitment now to do something every single week, and if you achieve it, it will better your financial situation. Charles Duhigg, a leading researcher on habits, has explained that most habit formation takes place as cue, routine, and reward.[3] The 52-Week Money Challenge is the same way:

Cue: Every week, you remember you need to do this. Routine: You keep doing it! Reward: Now you have more savings.

Hacking the Money Challenge

How do you make the conscious decision not to spend dollars on fun things? For example, you know there’s a good chance you’ll spend more money during the holidays— flights to see family members, gifts for family and co-workers, maybe even New Year’s Eve plans. You might spend more in the summer too: vacations and summer sales. How do you make sure you don’t do that and stay on track with your 52-Week Money Challenge? There are three main hacks if you want to get the most out of the 52-Week Money Challenge:

Automate Money Storing and Transferring

The whole point of automation is making things simpler, and that can work in the 52-Week Money Challenge too. Just automate out the payments beforehand and you’ll never even think about it. It will just not be there—it’ll be savings. Your bank can help you with this, as can apps like Qapital.

Combine the Challenge with Another Goal

Consider merging the 52-Week Money Challenge with a weight loss challenge— lose 1 pound per week, for example— or a spending challenge. You could reduce the number of times you eat out each week in a given month (8, 6, 4, 2) and start from a smaller number each month (7, 5, 3, 1 the next month; then 6, 4, 2, 0). If you’re tying a money-saving challenge (the 52-Week Money Challenge) with another challenge that will directly impacting savings (eating out less or trying to lose weight— or both!), there will be increased motivation to save money.

Go Beyond the 52 Weeks

Each year you’d save $1,378. In five years, you’d have $6,890. In 10 years, $13,780. It could lead to some pretty nice vacations, if nothing else. Just don’t stop. The 52-Week Money Challenge is a low impact way to save money.

Challenge Accepted

Go do it. Do the 52-Week Money Challenge. And think on some of the hacks, or create your own— for example, if Week 1 is $2 and then Week 2 is $4, you’d double your savings ($2,756) for the year. In 10 years, you’d have over $27,000 in savings. That would be impressive given the numbers we initially discussed. Most Americans have less than $1,000 in savings, so even if you just do the basic 52-Week Money Challenge with the hacks discussed, you’ll end the year with more than most people. Saving is important, whether the savings leads to leisure pursuits or solving emergencies. Start with the 52-Week Money Challenge and see how easy it can be. Featured photo credit: http://money.cnn.com/2017/05/10/retirement/retirement-savings-return/index.html via money.cnn.com