So how was I able to fix it, and how you can do the same? There are some steps that need to be taken, but before I can tell you what I mean let me explain what this post isn’t about: it’s not about how to make more money, it’s not about saying no to the nice things in life, and it’s not about starving. It is, however, about being aware of where most of your money goes, and about being conscious of your spending habits.

Monitoring is the first step

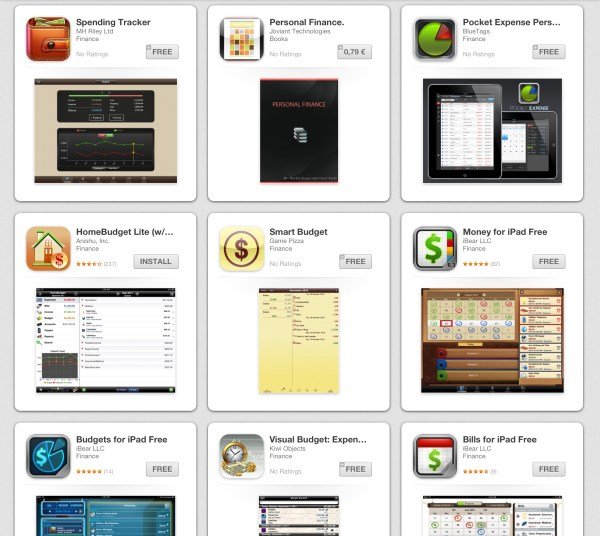

I’m sure you’re familiar with the saying that what gets measured gets improved. This is a rule that’s valid for your personal budget as well. If you want to keep things under control, you need to start by paying close attention to what you’re spending money on. Now, this isn’t the moment where you should restrain yourself from buying something you’d normally buy. It’s just about writing down your expenses and keeping them for later analysis. Keeping note of very expense sounds like a lot of work, but the 21st century comes to rescue. If you have an iPhone or an iPad (or an Android device) then you can use one of many personal financing apps that are available out there (image below).

There are both free and paid solutions, such as:

Spending Tracker Mint.com Personal Finance HomeBudget Lite Smart Budget Money for iPad Free

I didn’t have the chance to test them all out, so choosing the exact app you’re going to use is up to you. You can start by going to the App Store and searching for either “budget” or “personal finance”, but make sure that your app allows you to:

categorize your expenses add expenses on specific dates add your salary and any income you have input all costs using your local currency change the currency (optional, if you’re spending money in more than one currency)

One month head start

Unfortunately, you won’t be able to do everything overnight: you need to spend some time getting data and building your spending profile, so to speak. Usually one month is enough to gather a sufficient amount of data, but if your spending habits are a bit more unpredictable then you might need more time. During this initial month, make sure to set a habit of noting down every expense you make by putting it into your chosen app. Remember to use the right categories, as this will be the only way you’re going to able to analyze this data later on. Let me say this again: categorization is key to success here. For instance, you can divide your expenses into these categories: rent, food, going out, coffee, alcohol, bills, gas, entertainment, education, etc. This is also a good opportunity to input your salary and any other profits you’re making (e.g.: freelancing, securities, bonds, stocks).

Review

When the month is over, it’s time to review your expenses and take notice of all possible areas for improvement. As I said before, the key here is to look at categories of your expenses: some of these categories are completely mandatory, like rent, or your electricity bill, so you can’t do anything about them. Others are not mandatory, but they are part of your “joy of life,” so to speak, so you wouldn’t necessarily want to get rid of them. The rest, however, may prod you into making some conscious decisions and taking a different direction with your money. Start by looking at each category and deciding if you’re comfortable with the amount of money it costs you. If you’re not, then try to find cheaper alternatives or erase some expenses completely. For instance, one of the most interesting revelations for me was that I was spending an incredible amount of money on coffee. The first step I took was the decision to drink more coffee at home as opposed to going out—this one step cut my coffee expenses in half. This is just an example, but I’m sure you can see the potential that lies in this method. The more you categorize your expenses, the more areas of improvement you’ll be able to find. Again, this isn’t about lowering the quality of your life—it’s only about erasing stupid expenses and finding new and improved ways to experience as much joy in life and spending less money at the same time. Of course, if the amount of money you spend is more than the amount you earn, then you’re in a lot of trouble. Once you input your salary, every personal finance app will let you know about such a situation. When you have all your categories sorted, you can move to the next phase.

Planning

The final step is to plan your spending for the next month. Now, this isn’t about writing down what you can and cannot buy, but more about placing some simple guidelines in the back of your head. Things like: drink coffee at home, don’t buy more than three beers at a time, don’t use credit cards to buy cheap items, buy less clothing, and so on. If you manage to pay attention to such guidelines for the duration of the next month, you’ll surely be able to lower some of your expenses with no loss in your quality of life. Actually, being aware of our personal budgets is not that difficult once we realize one thing: the devil is in the details, and when it comes to personal finance, details = small expenses. Subconsciously, we all know this. If we’re planning to buy something big—and I mean massively big like some Fort Worth real estate or a new car—then it doesn’t actually affect our monthly budgets. I mean, we always have everything carefully planned out, and know how much we can afford to spend exactly, and how much the investment is going to cost us over the years. However, buying something small here and there doesn’t seem like it can hurt us, but when we add everything at the end of the month, we can see that all those small things have turned into one surprisingly big bill. Personal finance apps help us to notice this and then take the right action… as long as we remember to put every expense into the app. I strongly encourage you to give it a shot and check how much money you can save. For me, the change has been significant, to say the least. What’s your take on this? Have you faced any surprising problems when dealing with your daily expenses?