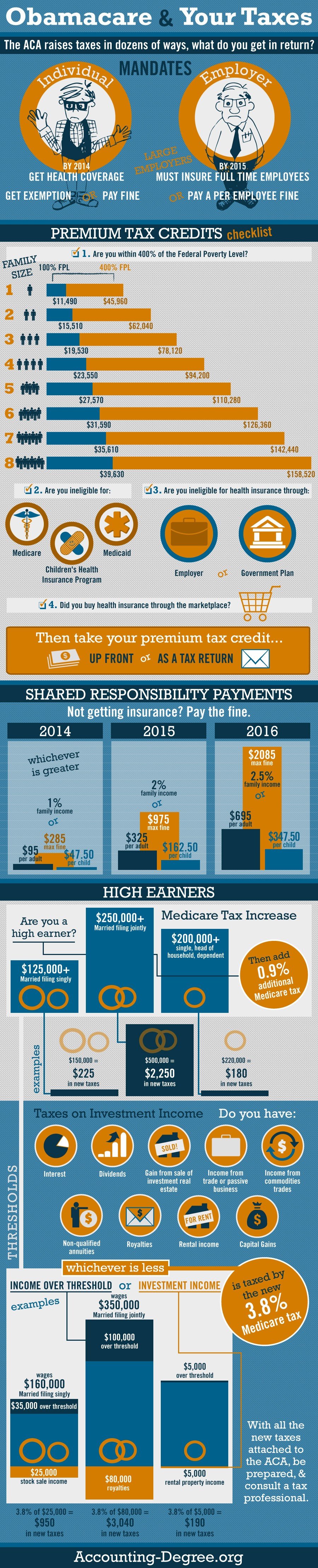

What’s even worse is that the fine will increase each year. For 2014 you’ll either need to pay 1% of your family income, or $95 per adult and $47.50 per child (up to a maximum of $285). As you can see, this can really add up each month. You can also go through the Premium Tax Credit checklist and see if you qualify. This credit is meant to help make purchasing health insurance coverage more affordable for those with moderate income. If you do, you can choose to get your credit up front or as a tax return.

There is a lot of great information here that everyone should be aware of. Be sure to share this so that others will know how ObamaCare and taxes work hand-in-hand, and how they’ll possibly be affected. Obamacare and Your Taxes | Accounting Degree Review